Avoiding Financial instability is a pressing concern for business owners across industries. The unpredictability of revenue streams, fluctuating market conditions, and unexpected expenses can create a volatile financial environment that threatens the stability and growth of any business. Addressing these concerns requires a proactive approach and a comprehensive understanding of financial management principles. Here we’ll address the root causes of financial instability, its implications for businesses, and strategic measures that business owners can take to mitigate risks and foster financial stability.

Avoiding Financial instability is a pressing concern for business owners across industries. The unpredictability of revenue streams, fluctuating market conditions, and unexpected expenses can create a volatile financial environment that threatens the stability and growth of any business. Addressing these concerns requires a proactive approach and a comprehensive understanding of financial management principles. Here we’ll address the root causes of financial instability, its implications for businesses, and strategic measures that business owners can take to mitigate risks and foster financial stability.

The Nature of Financial Instability

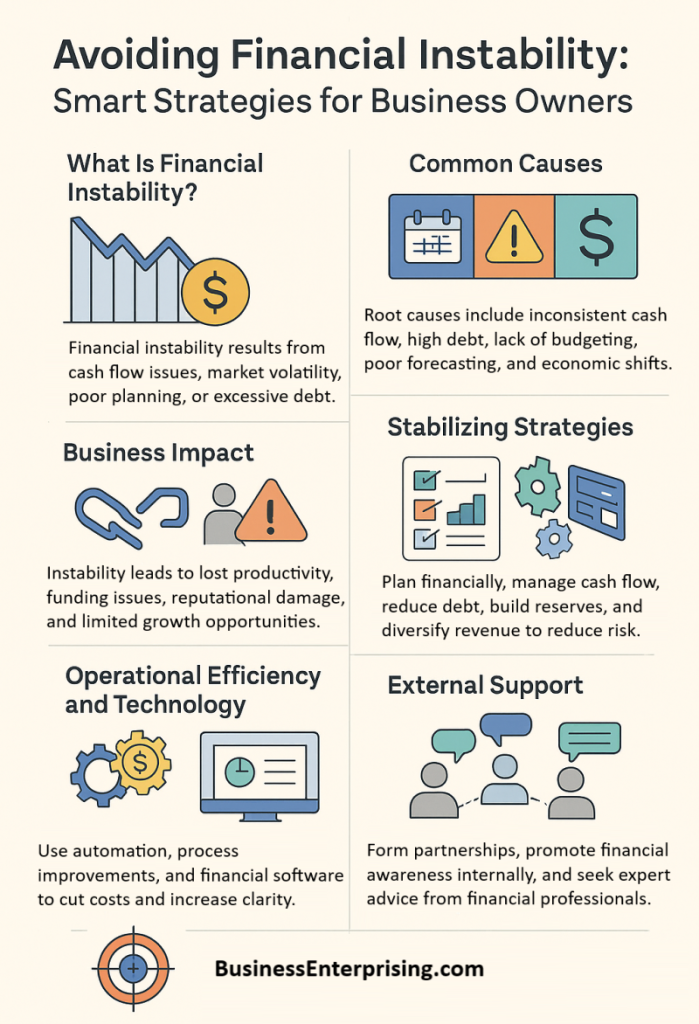

Avoiding financial instability is ensuring positive cash flow at all times. This instability can stem from various sources, including economic downturns, poor financial planning, operational inefficiencies, and external shocks such as sudden market changes or natural disasters. For business owners, the fear of financial instability is particularly acute because it can disrupt operations, erode profitability, and ultimately jeopardize the survival of the business.

Causes of Financial Instability

Several factors contribute to financial instability in businesses. One primary cause is inadequate financial planning. Without a clear financial strategy, businesses may struggle to manage their resources effectively, leading to overspending and insufficient savings. Additionally, a lack of proper budgeting and forecasting can prevent businesses from anticipating future financial needs and preparing accordingly.

Another significant factor is inconsistent cash flow. Businesses rely on steady cash flow to cover operational expenses, pay employees, and invest in growth opportunities. When cash flow is erratic, it becomes challenging to meet these obligations, resulting in financial strain. This inconsistency can be due to delayed payments from clients, seasonal fluctuations in sales, or unexpected expenses.

Furthermore, high levels of debt can contribute to financial instability. While borrowing can provide essential capital for growth, excessive debt can become burdensome, especially if revenue falls short of expectations. High-interest payments can drain resources and limit a business’s ability to invest in critical areas.

Market volatility also plays a crucial role in financial instability. Economic downturns, changes in consumer behavior, and competitive pressures can all impact a business’s financial performance. In such environments, businesses may face declining sales and shrinking profit margins, exacerbating financial instability.

Implications of Financial Instability

The consequences of financial instability are far-reaching and can affect every aspect of a business. Operational disruptions are common, as businesses may need to cut costs by reducing staff, delaying projects, or scaling back on essential services. Such measures can harm productivity and employee morale, creating a cycle of declining performance and increasing financial stress.

Financial instability also affects a business’s ability to secure funding. Lenders and investors are less likely to support businesses with uncertain financial prospects, making it difficult to obtain loans or attract investment. This lack of funding can hinder growth initiatives and limit the business’s ability to respond to market opportunities.

Moreover, financial instability can damage a business’s reputation. Suppliers, customers, and partners may lose confidence in a business that struggles to manage its finances, leading to strained relationships and lost business opportunities. Over time, this erosion of trust can further undermine the business’s stability and prospects for recovery.

Strategies for Mitigating Financial Problems

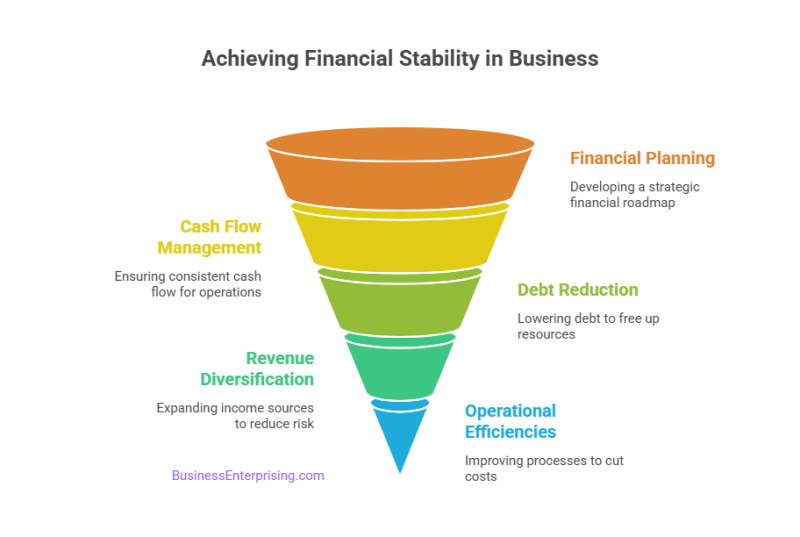

While avoiding financial instability is challenging, business owners can take proactive steps to mitigate risks and build a more stable financial foundation. Effective financial planning is critical. Developing a detailed financial plan that includes budgeting, forecasting, and cash flow management can help businesses allocate resources efficiently and prepare for future needs. Regularly reviewing and updating this plan ensures that it remains relevant and responsive to changing conditions.

Improving cash flow management is another essential strategy. Businesses should implement measures to expedite receivables, such as offering incentives for early payments or tightening credit terms. Additionally, maintaining a cash reserve can provide a buffer against unexpected expenses and revenue shortfalls, enhancing financial resilience.

Reducing debt levels can also alleviate financial pressure. Businesses should aim to manage their debt load by prioritizing high-interest debts and seeking favorable refinancing options. By lowering debt obligations, businesses can free up resources for investment and reduce the risk of financial distress.

Furthermore, diversifying revenue streams can help stabilize income. Relying on a single product, service, or market can be risky, especially in volatile environments. Expanding the range of offerings and exploring new markets can create additional revenue sources, reducing dependency on any single stream.

Investing in technology and operational efficiencies can also contribute to financial stability. Automation and process improvements can lower operational costs, increase productivity, and enhance profitability. Additionally, adopting financial management software can provide real-time insights into financial performance, enabling better decision-making.

External Assistance

Engaging in strategic partnerships can provide additional support and resources. Collaborating with other businesses, suppliers, or industry associations can create opportunities for cost-sharing, joint ventures, and knowledge exchange. These partnerships can strengthen the business’s position and provide a safety net during challenging times.

Moreover, fostering a culture of financial awareness within the organization is essential. Educating employees about the importance of financial stability and involving them in cost-saving initiatives can create a collective effort towards achieving financial health. Encouraging open communication about financial goals and challenges can also enhance transparency and accountability.

Lastly, seeking professional advice can be invaluable. Financial advisors, accountants, and consultants can provide expert guidance on managing finances, navigating complex regulations, and developing long-term strategies. Their insights can help businesses identify potential risks and opportunities, enabling more informed decision-making.

Avoiding financial instability is a pervasive concern for business owners, but it is not insurmountable. By understanding the root causes of financial instability and implementing strategic measures, businesses can navigate financial challenges and build a more resilient foundation. Effective financial planning, improved cash flow management, debt reduction, revenue diversification, operational efficiencies, strategic partnerships, and professional advice are all critical components of a comprehensive approach to financial stability.

In conclusion, while the path to financial stability requires dedication and proactive effort, the benefits of a stable financial environment are well worth it. A financially stable business is better equipped to weather economic fluctuations and seize growth opportunities. By prioritizing financial health, business owners can ensure the long-term success and sustainability of their enterprises, ultimately achieving their business goals and securing a prosperous future.