Navigating the maze of business financing can be daunting, which is why a thorough business loan eligibility guide is invaluable. If you’re an entrepreneur gearing up to apply for a loan, understanding what lenders look for and how to best prepare your application can significantly enhance your chances of approval. This introduction will walk you through the key aspects of business loan eligibility, from understanding basic requirements such as credit scores and financial history to choosing the right type of loan for your business needs. Each step is crucial in moving closer to securing the financial support necessary to grow and sustain your business.

Navigating the maze of business financing can be daunting, which is why a thorough business loan eligibility guide is invaluable. If you’re an entrepreneur gearing up to apply for a loan, understanding what lenders look for and how to best prepare your application can significantly enhance your chances of approval. This introduction will walk you through the key aspects of business loan eligibility, from understanding basic requirements such as credit scores and financial history to choosing the right type of loan for your business needs. Each step is crucial in moving closer to securing the financial support necessary to grow and sustain your business.

Understanding Business Loan Requirements

Navigating the basic requirements for securing a business loan is a key step outlined in any business loan eligibility guide. When you apply for a business loan, lenders typically evaluate several fundamental factors to determine if you qualify.

Firstly, your credit score plays a crucial role. It not only affects your ability to secure a loan but also influences the terms and interest rates offered. Generally, a higher credit score indicates lower risk to lenders, which can lead to more favorable loan terms.

Annual revenue is another significant factor that lenders consider. It provides them with insight into your business’s financial health and ability to repay the loan. Most lenders require a minimum annual revenue amount before they will consider your application, ensuring that your business generates enough income to support debt repayment.

Operational history is also critical, as lenders want to invest in businesses with a proven track record of stability and profitability. Typically, businesses need to have been in operation for at least two years to qualify for most traditional business loans. This history helps lenders gauge business sustainability and the management team’s expertise.

By understanding these criteria, you can better prepare your business for the loan application process. Improving your credit score, increasing your revenue, and maintaining clear financial records can enhance your chances of loan approval, setting a solid foundation for your financial requests.

Types of Business Loans Available

Understanding the different types of business loans available is crucial for choosing the right financing option for your needs. Each type of loan serves distinct purposes and has specific eligibility requirements, as outlined in any comprehensive business loan eligibility guide.

Term Loans are a common type of business loan, where you receive a lump sum of cash upfront, which is then repaid with interest over a predetermined period. These loans are suitable for a wide range of business purposes, from expanding operations to purchasing equipment.

SBA Loans, facilitated by the Small Business Administration, offer a variety of loan programs that provide lower interest rates and longer repayment terms compared to conventional bank loans. These loans are ideal for businesses looking to grow but require the borrower to meet stringent eligibility criteria.

Lines of Credit provide businesses with the flexibility to borrow up to a certain limit and pay interest only on the amount borrowed. This type of financing is perfect for managing cash flow and unexpected expenses, allowing you to draw and repay funds as needed.

Equipment Financing is tailored specifically for purchasing business equipment. In this arrangement, the equipment itself often serves as collateral for the loan, which can help to secure lower interest rates.

By familiarizing yourself with these different types of loans, you can better assess which option best fits your business’s financial needs and growth objectives. Each loan type offers unique advantages, so consider your business’s financial situation and goals when deciding.

Documentation Needed for Application

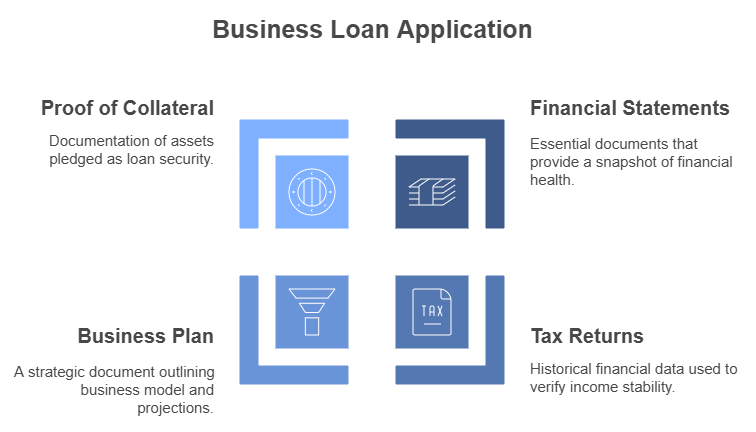

Preparing the right documentation is a critical step in the application process for a business loan. As outlined in any thorough business loan eligibility guide, having the correct paperwork ready can significantly streamline your application process. Here are the key documents you’ll likely need:

Firstly, business financial statements are crucial. These include your balance sheet, profit and loss statements, and cash flow statements. They provide lenders with a snapshot of your business’s financial health and your ability to repay the loan.

Secondly, you’ll need to provide tax returns. Lenders generally request your business’s tax returns from the last two to three years to verify your income and business stability.

A business plan is also vital. This document should detail your business model, products, market, and financial projections. It reassures lenders of your strategic direction and potential for growth.

Lastly, proof of collateral may be required if you’re applying for a secured loan. This could include documents related to any assets you’re pledging as security for the loan.

Each of these documents plays a vital role in your loan application. They collectively help lenders assess risk and decide on your loan application’s merit. Ensure these documents are accurate, up-to-date, and readily available to present when applying for a loan.

How to Improve Loan Eligibility

Improving your business’s eligibility for a loan is a critical aspect of financial management, and the right strategies can make a significant difference. Following the guidelines provided in a comprehensive business loan eligibility guide can help enhance your chances of approval.

First, focus on improving your business’s credit score. This is one of the most straightforward ways to increase your loan eligibility. Pay your bills on time, reduce outstanding debts, and avoid opening new credit lines excessively. A higher credit score reassures lenders of your reliability and financial responsibility.

Increasing profitability is another effective strategy. More profitable businesses present less risk to lenders. Work on optimizing your operations to increase your margins, perhaps by reducing costs or increasing sales. Detailed financial records showing steady growth in profits can significantly bolster your loan application.

Offering collateral can also improve your loan eligibility. Collateral reduces the risk for lenders since it provides a security they can claim if the loan is not repaid. Assets commonly used as collateral include real estate, equipment, or inventory. Be mindful, however, that offering collateral involves risk, so consider this option carefully.

Additionally, maintaining a clear and detailed business plan can demonstrate to lenders that you have a solid strategy for using the loan wisely and growing your business. This shows not just intent but a path to repayment.

By implementing these tips, you can enhance your business’s appeal to lenders and improve your chances of securing a business loan. Each step you take to bolster your financial standing or mitigate lending risks can be a decisive factor in your loan approval process.

Common Reasons for Loan Rejection

Understanding why business loans get rejected can help you avoid common pitfalls when applying. A well-crafted business loan eligibility guide should discuss several frequent reasons for loan rejection that you should be aware of.

Firstly, low credit scores are a common reason for denial. Lenders see credit scores as a measure of your reliability and financial history. A low score can signal to lenders that you might be a high-risk borrower. Regularly monitoring and working to improve your credit score is crucial before applying.

Secondly, insufficient collateral can lead to loan rejections. Collateral secures your loan, and if the assets you offer are considered insufficient or too risky to cover the loan amount, lenders might not approve your application. Ensure that you understand the collateral requirements and assess your assets realistically before securing the loan.

Additionally, weak business performance, reflected in your financial statements, can deter lenders. If your business shows low profitability or inconsistent revenue, it can be seen as unstable. Lenders are less likely to offer loans to businesses that do not demonstrate the capacity for sustainable operation and growth.

Another reason could be a poorly constructed or unclear business plan. Lenders want to see that you have a solid strategy for how the loan will be used to grow your business. A well-thought-out business plan shows the lender that you are serious and have a clear path to increased revenue.

By addressing these common issues before applying for a loan, you can enhance your chances of approval. Always ensure your documentation is thorough and your financial projections are realistic. This proactive approach can make a significant difference in successfully securing a business loan.

Alternatives to Traditional Bank Loans

If traditional bank loans are not an option for your business, you can explore several alternative financing methods. Many business loan eligibility guides detail these alternatives and offer viable solutions for funding.

Peer-to-Peer Lending (P2P) is one such option. It allows businesses to borrow money directly from investors online, bypassing traditional financial institutions. This method can often provide more flexible terms and quicker access to funds compared to traditional banks.

Merchant Cash Advances (MCA) offer another alternative, especially for businesses with significant credit card sales. This option provides an upfront sum of cash in exchange for a portion of future sales. While convenient, it’s important to note that the costs can be higher than other forms of financing.

Crowdfunding has also become a popular method, particularly for product-driven businesses or those with a strong consumer appeal. Platforms like Kickstarter and Indiegogo allow you to raise funds by pre-selling products or by receiving donations from the public. This not only funds your business but also markets your product.

Each of these alternatives comes with its own set of benefits and risks. Peer-to-peer lending might offer lower interest rates than a merchant cash advance but requires a strong credit profile. Merchant cash advances provide quick access to funds but at the cost of higher fees. Crowdfunding can prove highly beneficial but requires significant marketing effort and comes with no guarantee of reaching your funding goal.

When considering these options, it’s essential to carefully assess your business’s financial situation, the cost of capital, and the potential impact on your cash flow. Understanding these factors will help you choose the right financing method to support your business growth.

Conclusion

As we conclude this exploration of business loans through our business loan eligibility guide, remember that understanding the requirements and options available is crucial for securing the right financing for your business. Each type of loan, whether traditional or alternative, has its unique features and benefits. Assessing your business needs, financial health, and future goals will guide you in choosing the most appropriate option.

Continuously improving your business’s financial standing and being aware of the lending landscape will enhance your chances of approval. Keep your documentation thorough and up-to-date, maintain a healthy credit score, and develop a solid business plan. These steps are not only essential for loan applications but are also good business practices.

Whether you’re just starting or looking to expand, the right knowledge and preparation can make the financing process smoother and more successful. Equip yourself with the insights from a detailed business loan eligibility guide, and take confident steps toward securing your business’s financial future.