In the world of decision-making, human behavior often defies logic and rationality. One of the most intriguing psychological phenomena that influence our decisions is Loss Aversion. This concept, rooted in behavioral economics, explains why people tend to prefer avoiding losses over acquiring equivalent gains. Loss Aversion significantly impacts financial decisions, marketing strategies, and everyday choices. By understanding this, individuals and businesses can make more informed decisions and better predict consumer behavior.

What is Loss Aversion?

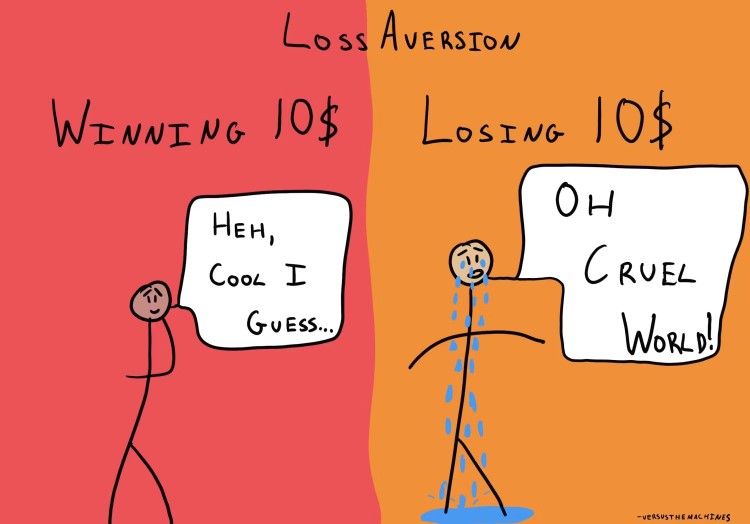

Loss Aversion is the tendency for people to experience the pain of losing something more intensely than the pleasure of gaining something of equal value. This psychological bias means that the fear of loss often outweighs the potential benefits of a gain. This leads individuals to make decisions that prioritize avoiding losses over achieving gains. For example, the discomfort of losing $50 typically feels more significant than the satisfaction of gaining $50, even though the monetary value is the same.

This concept was popularized by psychologists Daniel Kahneman and Amos Tversky. They introduced it as a key component of prospect theory. Their research revealed that Loss Aversion influences how people evaluate risk, make decisions, and respond to potential outcomes. Understanding this helps explain why individuals often act conservatively, even when the potential rewards are substantial.

The Psychology Behind Loss Aversion

Loss Aversion is deeply rooted in the way our brains are wired. One of the key psychological principles at play is the concept of loss being more emotionally impactful than gain. This asymmetry in emotional responses means that the prospect of losing something valuable triggers a stronger negative emotional reaction than the positive emotions associated with a comparable gain.

Another factor contributing to this is the evolutionary perspective. From a survival standpoint, avoiding losses could have had more significant implications than achieving gains. Early humans who were cautious and avoided losses, such as scarce resources or threats, were more likely to survive. This survival mechanism may have been passed down through generations, leading to an innate tendency to prioritize loss avoidance.

Additionally, Loss Aversion is connected to the endowment effect. This is the idea that people value things more simply because they own them. When individuals own something, they become more attached to it, making the prospect of losing it more distressing. This heightened attachment reinforces Loss Aversion. It causes people to overvalue what they already possess and avoid taking risks that could lead to loss.

Practical Applications of Loss Aversion in Marketing

Loss Aversion plays a critical role in marketing strategies. The reason for this is that it influences how businesses frame their products and offers to appeal to consumers. One common application is in the use of scarcity and urgency tactics. For instance, marketers might highlight that a product is available for a limited time or in limited quantities. This framing taps into Loss Aversion by creating a fear of missing out (FOMO). This prompts consumers to make a purchase to avoid the potential loss of the opportunity.

Another marketing application of this is the use of risk-free trials or money-back guarantees. By offering these options, businesses reduce the perceived risk associated with a purchase, making it easier for consumers to commit. The assurance that they can recover their investment if unsatisfied minimizes the fear of loss. This encourages more people to take advantage of the offer.

Additionally, Loss Aversion is often leveraged in loyalty programs and subscription services. For example, companies might offer rewards points or exclusive benefits to customers who maintain their subscription or loyalty status. The prospect of losing these benefits if they cancel can motivate customers to stay engaged. This encourages them to continue their relationship with the brand.

In pricing strategies, Loss Aversion can be used to justify premium pricing. It does this by emphasizing the potential losses associated with choosing a lower-priced alternative. Marketers might highlight the superior quality, durability, or additional features of their product. This suggests that opting for a cheaper option could result in dissatisfaction or the need for replacement. This approach encourages consumers to view the higher-priced product as a safer investment, reducing the perceived risk of loss.

The Impact of Loss Aversion on Financial Decisions

Loss Aversion also has significant implications in the realm of finance. Here it affects how individuals and investors make decisions regarding risk and reward. One of the most notable impacts is on investment behavior. Investors who exhibit Loss Aversion are more likely to hold onto losing investments for too long. They do this hoping to avoid a loss. This behavior, known as the “disposition effect,” can lead to suboptimal investment outcomes, as individuals may miss opportunities to reallocate their capital to more profitable ventures.

Moreover, Loss Aversion can influence risk tolerance. Investors who are highly loss-averse may shy away from high-risk, high-reward opportunities, preferring safer, lower-yield investments. While this conservative approach can protect against potential losses, it may also limit the potential for significant gains. Understanding Loss Aversion can help investors recognize when their fear of loss is hindering their ability to make balanced decisions.

In personal finance, Loss Aversion can affect how people approach savings and spending. For example, individuals may be more inclined to save money if they perceive a potential loss, such as a future expense or economic downturn, as imminent. Conversely, the fear of losing money to inflation or market volatility might prompt individuals to make more conservative financial decisions, potentially sacrificing long-term growth for short-term security.

Overcoming Loss Aversion for Better Decision-Making

While Loss Aversion is a natural psychological bias, being aware of it can help individuals and businesses make more informed and balanced decisions. One way to overcome Loss Aversion is to reframe the way decisions are presented. Instead of focusing solely on the potential losses, it can be helpful to highlight the potential gains and the long-term benefits of taking calculated risks.

In investment decisions, for example, focusing on the potential for growth and diversification can help counteract the fear of short-term losses. By adopting a long-term perspective, investors can make decisions based on their overall financial goals rather than being swayed by the emotional impact of potential losses.

Another strategy for overcoming Loss Aversion is to practice mindfulness and self-awareness. When faced with a decision that triggers fear of loss, taking a step back to evaluate the situation objectively can help reduce the emotional impact. By considering the probabilities and potential outcomes, individuals can make more rational decisions that align with their goals and values.

Additionally, businesses can help customers overcome Loss Aversion by providing clear information and emphasizing the value of their products or services. Transparent communication about the benefits and potential risks can build trust and reduce the perceived threat of loss. Offering guarantees, return policies, or risk-free trials can also alleviate concerns and encourage more confident decision-making.

Ethical Considerations

While Loss Aversion is a powerful tool in marketing and decision-making, it also raises ethical considerations. Manipulating consumers’ fear of loss can lead to decisions that are not in their best interest, potentially causing them to overspend or make choices they later regret. Businesses should use Loss Aversion responsibly, ensuring that their marketing practices are transparent and customer-focused.

One way to approach this ethically is by using Loss Aversion to highlight genuine benefits and value rather than creating artificial scarcity or pressure. For example, emphasizing the long-term value of a high-quality product over cheaper alternatives can help customers make informed choices that align with their needs. Providing clear and honest information about the potential risks and rewards can also empower consumers to make decisions that are right for them.

Moreover, businesses should be mindful of the potential impact of this concept on vulnerable populations, such as those with limited financial literacy or those prone to impulsive spending. Tailoring marketing strategies to be inclusive and supportive can help ensure that all customers are making decisions that benefit their financial well-being.

Loss Aversion is a powerful psychological phenomenon that influences decision-making in various aspects of life, from financial choices to consumer behavior. By understanding how Loss Aversion works, individuals and businesses can make more informed decisions, avoid common pitfalls, and leverage this knowledge in ethical ways. While the fear of loss is a natural and often protective instinct, being aware of its impact can lead to more balanced and rational choices, ultimately contributing to long-term success and well-being.