Starting a Business: Licensing and Permits Requirements

Starting a business involves obtaining the correct licenses and permits, and these requirements vary based on your business type and location. A basic part of any US business regulations overview is understanding federal, state, and local requirements. Each level has unique guidelines, and not meeting these can delay your operations or result in fines.

At the federal level, businesses in regulated industries, like transportation, agriculture, or alcohol sales, need specific licenses. For instance, the Bureau of Alcohol, Tobacco, Firearms and Explosives oversees alcohol-related businesses, while the Department of Agriculture regulates businesses in food and livestock. Researching federal agencies relevant to your industry is essential, as each has distinct licensing rules.

State requirements depend on your business type and location. Most states require general business licenses, but certain professions, like healthcare or legal services, need specific state-issued permits. Additionally, some states require a seller’s permit if you sell goods. Consulting your state’s regulatory office is a practical step for understanding what applies to you.

Local permits often focus on zoning, health, and safety. For example, restaurants need health permits, and home-based businesses might need zoning approval. Checking with city or county offices clarifies local requirements. Following these steps ensures your business meets the licensing standards at every level. With the right permits in place, you’re better positioned for a smooth business launch.

Labor and Employment Laws

Labor and employment laws form a significant part of the US business regulations overview, impacting every business that hires employees. Compliance with these regulations is critical to maintaining fair treatment and safety within the workplace. Key areas include minimum wage standards, overtime pay, workplace safety, and anti-discrimination protections.

Minimum wage laws set the lowest hourly pay rate an employer must offer, with both federal and state rates in effect. Businesses must pay whichever is higher between the federal or state minimum wage. Additionally, laws require that employees working beyond 40 hours per week receive overtime pay, usually calculated at one and a half times the regular hourly rate. These pay regulations help protect workers from unfair compensation practices.

Workplace safety regulations, primarily overseen by the Occupational Safety and Health Administration (OSHA), set standards to prevent accidents and injuries. Employers are responsible for providing a safe working environment, ensuring employees understand safety procedures, and maintaining hazard-free spaces. In case of a violation, businesses face potential fines and liability issues.

Anti-discrimination laws protect employees from discrimination based on race, gender, age, disability, and other characteristics. The Equal Employment Opportunity Commission (EEOC) enforces these laws, ensuring fair hiring and treatment practices. Following these guidelines helps foster an inclusive workplace and protects your business from legal consequences.

Understanding and complying with these labor laws is essential for any business. Observing employment regulations not only supports ethical operations but also shields you from legal risks.

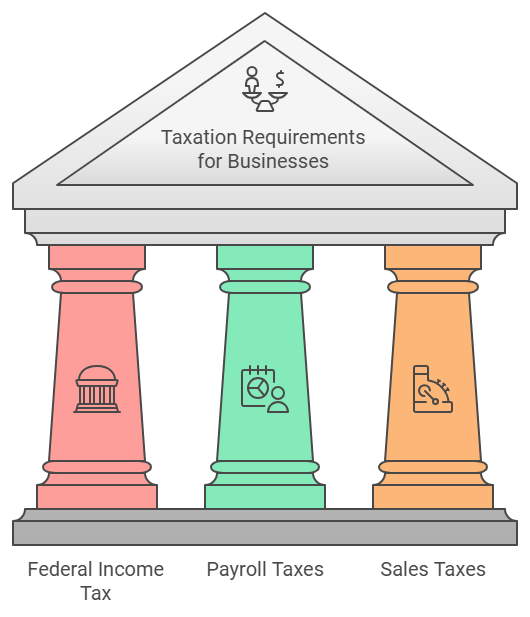

Taxation Requirements for Businesses

In the US business regulations overview, understanding taxation requirements is essential for maintaining compliance. Taxes impact nearly every aspect of your business, from income to employee wages. Federal, state, and local tax obligations vary, so you must know which ones apply to your operations. Federal income tax is a primary requirement for all businesses, with the tax rate depending on your business structure. Corporations, partnerships, and sole proprietorships face different filing requirements and rates, making it crucial to file accurately.

Beyond income tax, businesses must manage payroll taxes, which include Social Security and Medicare contributions. These taxes apply to wages paid to employees and must be withheld and submitted regularly. The IRS also requires employers to pay federal unemployment tax, which funds unemployment benefits for eligible workers. Payroll tax obligations are strict, and timely filing is essential to avoid penalties.

Many states and local jurisdictions also impose sales taxes on goods and services. If you sell products, collecting and remitting sales tax may be required, depending on the state. States set their own sales tax rates, and some local governments impose additional taxes. Businesses must register for a sales tax permit to legally collect sales tax from customers. Staying compliant with all applicable tax requirements ensures smooth operations and helps you avoid unexpected financial and legal challenges.

Environmental Regulations for Businesses

Environmental regulations are an essential part of the US business regulations overview, especially for businesses in industries that significantly impact the environment. The Environmental Protection Agency (EPA) enforces many of these regulations to limit pollution and promote sustainable practices. If your business produces emissions, disposes of waste, or uses hazardous materials, you may need to comply with several EPA guidelines. Key regulations include the Clean Air Act and the Clean Water Act, which set standards for air and water pollution.

For businesses with manufacturing or chemical processes, waste disposal and chemical management requirements are critical. Hazardous materials must be properly stored, handled, and disposed of to prevent contamination. The Resource Conservation and Recovery Act (RCRA) governs the safe disposal of hazardous waste. Compliance with RCRA not only protects the environment but also avoids heavy fines and potential legal action.

Staying informed about changing environmental regulations is crucial, as non-compliance can result in serious penalties. Regular audits and environmental assessments can help ensure that your practices align with current laws. Adhering to environmental regulations not only promotes sustainable operations but also builds customer trust and community goodwill.

Consumer Protection and Advertising Laws

Consumer protection and advertising laws form an essential part of the US business regulations overview, focusing on fair practices and transparency. These regulations protect consumers from deceptive practices and false advertising. The Federal Trade Commission (FTC) enforces many of these laws, including the Truth in Advertising Act. This act ensures that advertisements are not misleading and that claims are substantiated. Advertisements should be truthful, and businesses must have evidence to support any claims they make.

Data privacy is another critical aspect of consumer protection. With increasing concerns over personal data usage, laws like the California Consumer Privacy Act (CCPA) mandate strict privacy practices. These regulations require businesses to protect customer data and also inform consumers about how their data will be used. If you collect personal information from customers, you must ensure compliance with data privacy laws to avoid potential fines and maintain trust.

Protecting consumers against unfair practices goes beyond advertising and data privacy. Product safety regulations ensure that products meet safety standards before they reach the market. Non-compliance can lead to penalties and damage to a business’s reputation. Understanding and adhering to consumer protection laws help build customer loyalty as well as establish a reputation for reliability and fairness. By respecting these regulations, your business creates a safer and more transparent experience for consumers.

Intellectual Property and Trade Regulations

Intellectual property (IP) laws and trade regulations are essential parts of a US business regulations overview. IP protections like trademarks, copyrights, and patents help you safeguard your brand, innovations, and unique ideas. Trademarks protect logos, slogans, and brand names, which distinguishes your business from competitors. Patents, on the other hand, secure exclusive rights to inventions, ensuring that no one else can manufacture or sell them without permission. Copyrights cover creative works like designs, software, and written materials, preventing unauthorized copying and distribution.

For businesses involved in importing and exporting goods, trade regulations are equally important. These regulations ensure compliance with tariffs, restrictions, and documentation requirements, which differ by country and product. The United States Customs and Border Protection (CBP) enforces these rules, which cover everything from classification of goods to country-of-origin labeling. Following these guidelines helps you avoid delays, fines, and also other penalties associated with non-compliance.

Understanding intellectual property and trade regulations is essential for protecting your business interests as well as expanding into international markets. Properly securing your IP not only supports business growth but also builds brand value over time. Likewise, adhering to trade regulations enables smooth cross-border transactions, helping your business stay competitive on a global scale. By incorporating these elements into your strategy, you are taking significant steps toward long-term business success and compliance.

Conclusion

Understanding the complexities of compliance in the United States can greatly benefit your business operations and growth. This US business regulations overview highlights essential areas, from licensing and labor laws to environmental and intellectual property protections. Staying informed and proactive in these areas helps you avoid legal pitfalls while building a strong foundation for sustainable business practices.

By maintaining compliance across federal, state, and local levels, you set your business up for smoother operations as well as fewer interruptions. Whether you’re protecting your brand through intellectual property laws or meeting employment standards, attention to regulatory details is crucial. Remember, a well-rounded approach to compliance supports long-term success and also builds credibility with customers, partners, and employees alike.