Moreover, securing funding involves more than just convincing investors or lenders to support your vision. You need a well-structured business plan, accurate financial projections, and a clear long-term strategy. As you evaluate funding opportunities, it is equally important to understand how to use the capital effectively. Building financial readiness, coupled with maintaining transparency, increases your chances of long-term success and trust from stakeholders.

Ultimately, the right funding approach can drive your business toward sustainable growth. By focusing on startup funding essentials, you not only secure resources but also establish a roadmap for managing and scaling your business efficiently.

Types of Startup Funding Options

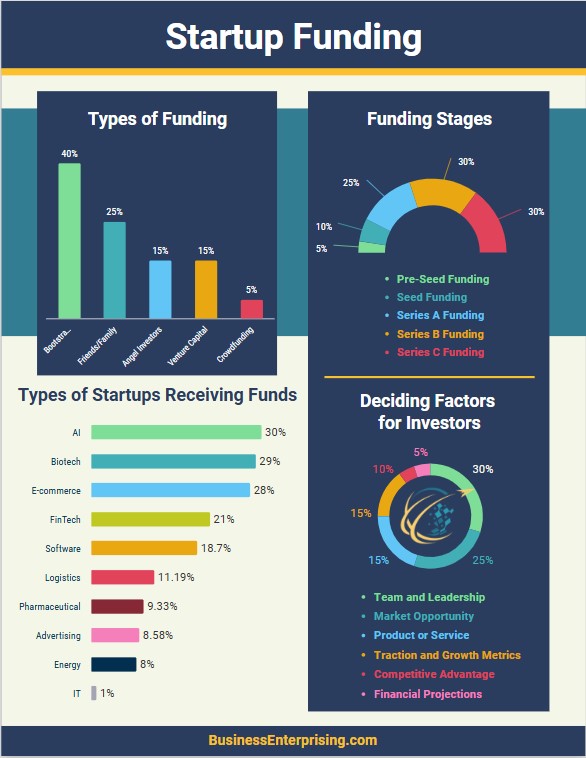

Exploring different funding options is a significant part of startup funding essentials. Each type of funding offers unique benefits and trade-offs. Choosing the most suitable option depends on your business goals, financial requirements, and growth plans.

Equity funding involves selling a share of your company to investors in exchange for capital. This method works well when your business needs substantial funding and has high growth potential. However, it requires giving up partial ownership, which may affect your decision-making control. Additionally, finding the right investors often takes time and effort, but the strategic support they provide can be invaluable.

Debt financing, in contrast, involves borrowing money that you repay over time with interest. This option allows you to retain complete ownership of your company, which can be an advantage if maintaining control is a priority. On the downside, debt creates financial obligations and could strain your cash flow if revenue becomes unpredictable. For startups with consistent income streams, debt financing can be an effective strategy.

Bootstrapping relies on using personal savings or reinvesting revenue from your business to cover costs. This approach gives you full control and eliminates reliance on external funding. However, limited access to capital may slow growth and expansion. Bootstrapping often works best for entrepreneurs with smaller initial capital needs and a willingness to grow gradually.

Crowdfunding provides another compelling option by enabling you to raise funds from a broad audience through platforms like Kickstarter or GoFundMe. This method not only generates capital but also helps validate your product and build an early customer base. That said, successful crowdfunding requires significant marketing efforts and may not guarantee consistent funding. It is particularly suited for innovative or consumer-focused businesses.

Creating a Compelling Business Plan for Investors

A strong business plan is a cornerstone of startup funding essentials. Investors use it to evaluate your vision, strategy, and growth potential. A well-prepared plan demonstrates that you have thoroughly analyzed your market and charted a clear path to success.

Financial projections are among the most critical elements of your business plan. These projections offer investors a realistic overview of your revenue streams, operating costs, and profitability over time. By illustrating how their funding will accelerate your business’s growth, you build trust and credibility with potential investors.

Market analysis is equally important for creating a compelling business plan. A thorough analysis shows that you understand your target audience, competitors, and industry trends. Investors want to see how your product or service addresses a gap in the market and stands out from competitors. This clarity reassures them of your ability to capitalize on existing opportunities.

Your business plan must also articulate your vision clearly. Highlight what makes your company unique and how you plan to scale. Including specific, measurable goals demonstrates focus and commitment. A well-defined vision not only resonates with investors but also provides a blueprint for your business operations.

By combining solid financial projections, detailed market analysis, and a clear vision, you strengthen your chances of securing funding. Investors value confidence and preparation, and a strong business plan serves as an essential tool for showcasing these qualities.

Understanding Venture Capital and Angel Investors

Venture capital and angel investors represent significant components of startup funding essentials. These funding sources often provide the financial and strategic support needed to scale rapidly. To access these opportunities, you must first understand how they work and what they expect from startups.

Venture capital firms invest in high-growth startups in exchange for equity. They typically focus on industries such as technology, healthcare, or renewable energy. In addition to funding, venture capitalists often bring strategic expertise, networks, and mentorship to help your business thrive. Angel investors, meanwhile, are individuals who invest their personal funds in early-stage startups. They tend to look for unique ideas and founders with strong leadership capabilities.

Both venture capitalists and angel investors seek businesses with a scalable model and robust market demand. They also prioritize clear financial projections, an experienced team, and a competitive edge. Demonstrating a thorough understanding of your market and competition can distinguish your pitch and secure their confidence.

When pitching to these investors, clarity and alignment with their priorities are key. Tailor your presentation to highlight the aspects of your business that resonate most with their portfolio or interests. Focus on your value proposition and how their funding will drive measurable results. Building trust through transparency and preparedness significantly enhances your chances of success.

These funding sources can provide substantial benefits, but the process remains competitive. By aligning your pitch with their expectations and showcasing your readiness, you position your startup for success. Venture capital and angel investors can play a pivotal role in transforming your business vision into reality.

Building Financial Readiness and Creditworthiness

Building financial readiness and creditworthiness is an essential part of startup funding essentials. A solid financial foundation increases your chances of securing funding and ensures your business remains stable during growth.

Managing cash flow effectively is one of the first steps to financial stability. Monitor your income and expenses closely to maintain a clear picture of your business’s financial health. Set aside reserves for unexpected costs and prioritize paying off any existing debts. Consistent cash flow management helps you demonstrate reliability to potential lenders or investors.

Building strong credit is equally important. Start by opening a business credit account and using it responsibly. Pay all bills on time and avoid carrying high balances. A positive credit history shows that you can manage financial obligations, which builds trust with creditors and investors. Regularly reviewing your credit report also helps you catch and address errors that could affect your score.

Establishing clear financial processes, such as accurate bookkeeping and regular financial reporting, is another key step. These practices improve transparency and make it easier to present your financial readiness to stakeholders. Using accounting software or working with a professional accountant can help streamline these tasks.

Taking these steps not only strengthens your business but also positions you for long-term success. Financial readiness and strong creditworthiness make your startup more appealing to funders and better equipped to handle future challenges. By focusing on these areas, you can build a stable foundation for sustainable growth.

Leveraging Government Grants and Subsidies

Government grants and subsidies offer a valuable, often overlooked, aspect of startup funding essentials. These programs provide funding without the requirement of repayment, making them highly appealing for entrepreneurs in various sectors.

Governments worldwide offer grants tailored to specific industries, including technology, green energy, and healthcare. These programs aim to stimulate innovation, create jobs, and promote economic development. Eligibility requirements often depend on your business size, location, or alignment with program goals. Researching relevant grant opportunities is an essential first step in identifying the right fit for your startup.

Applying for a grant typically requires a detailed business plan, clear financial projections, and a comprehensive explanation of how the funds will be used. Some programs may also require evidence of progress, such as prototypes or initial market validation. Following application guidelines and presenting a well-prepared proposal greatly improves your chances of securing a grant.

Leverage resources like government websites, local business development centers, and industry associations to navigate the grant application process. Successfully obtaining a grant not only provides funding but also enhances your credibility with investors and partners. Grants and subsidies, when used effectively, can serve as a springboard for innovation and growth while allowing you to maintain ownership of your business.

Scaling After Funding: Effective Use of Capital

Effectively managing your capital after securing funding is another essential aspect of startup funding essentials. Strategic use of funds can maximize their impact, ensuring your business achieves its short- and long-term goals.

Creating a detailed budget is the first step in managing your investment wisely. Allocate resources to key areas like product development, marketing, and operations based on your growth priorities. Regularly reviewing and adjusting your budget helps maintain alignment with evolving market conditions and business needs.

Accountability is equally important for ensuring the effective use of capital. Implement financial reporting processes and regularly update stakeholders on your progress. Investors appreciate transparency and clear communication, which can foster trust and encourage future support.

Scaling your startup requires disciplined execution and consistent focus on high-impact activities. With careful planning, strong accountability, and an emphasis on growth, you can effectively leverage funding to drive sustainable success.

Conclusion

Mastering startup funding essentials is a critical step toward building a successful and sustainable business. By understanding funding options, preparing thoroughly, and leveraging resources effectively, you create a foundation for growth. With the right strategy, you can turn your vision into a thriving reality and achieve long-term success.